What Homebuyers Need To Know About Credit Scores

Some Highlights

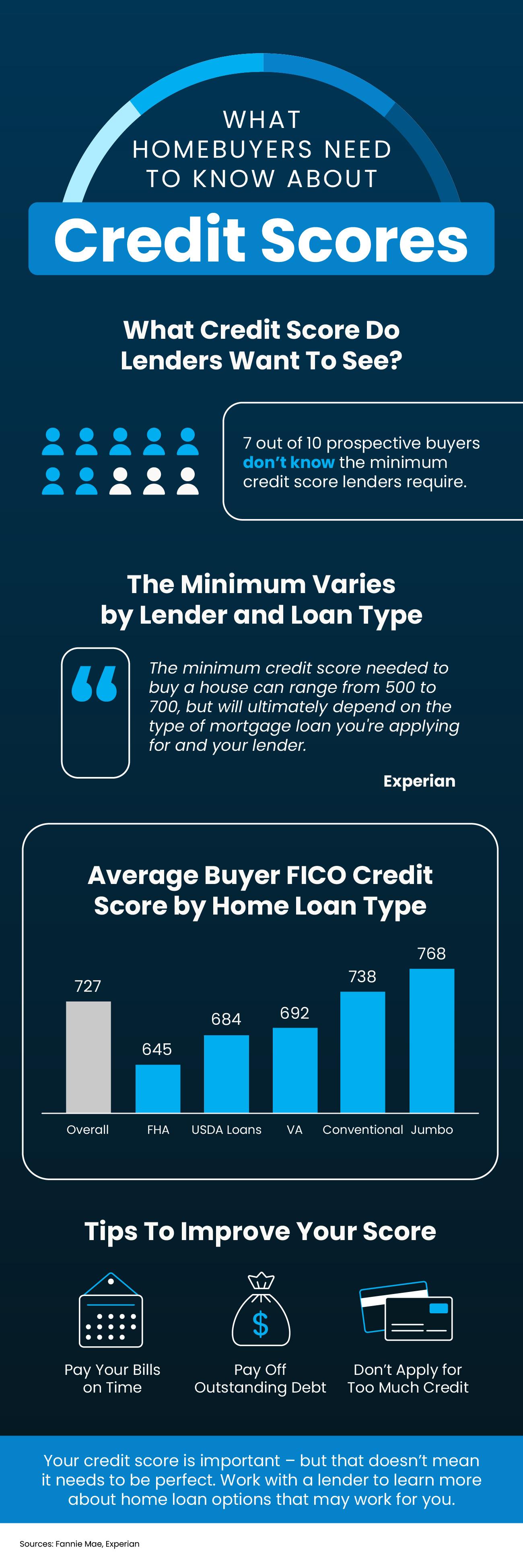

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

Categories

Recent Posts

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Why Some Homes Sell Quickly – and Others Don’t Sell at All

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Planning To Sell in 2026? Start the Prep Now

Is the Housing Market Going To Crash? Here’s What Experts Say

The $280 Shift in Affordability Every Homebuyer Should Know

2026 Housing Market Outlook

Why More Buyers Are Turning to New Construction This Year

Don’t Let Unrealistic Pricing Cost You Your Move

Why Home Prices Aren’t Actually Flat